Objective

Realize a total return exceeding the Russell Microcap Growth Index over a full market cycle.Investment Strategy

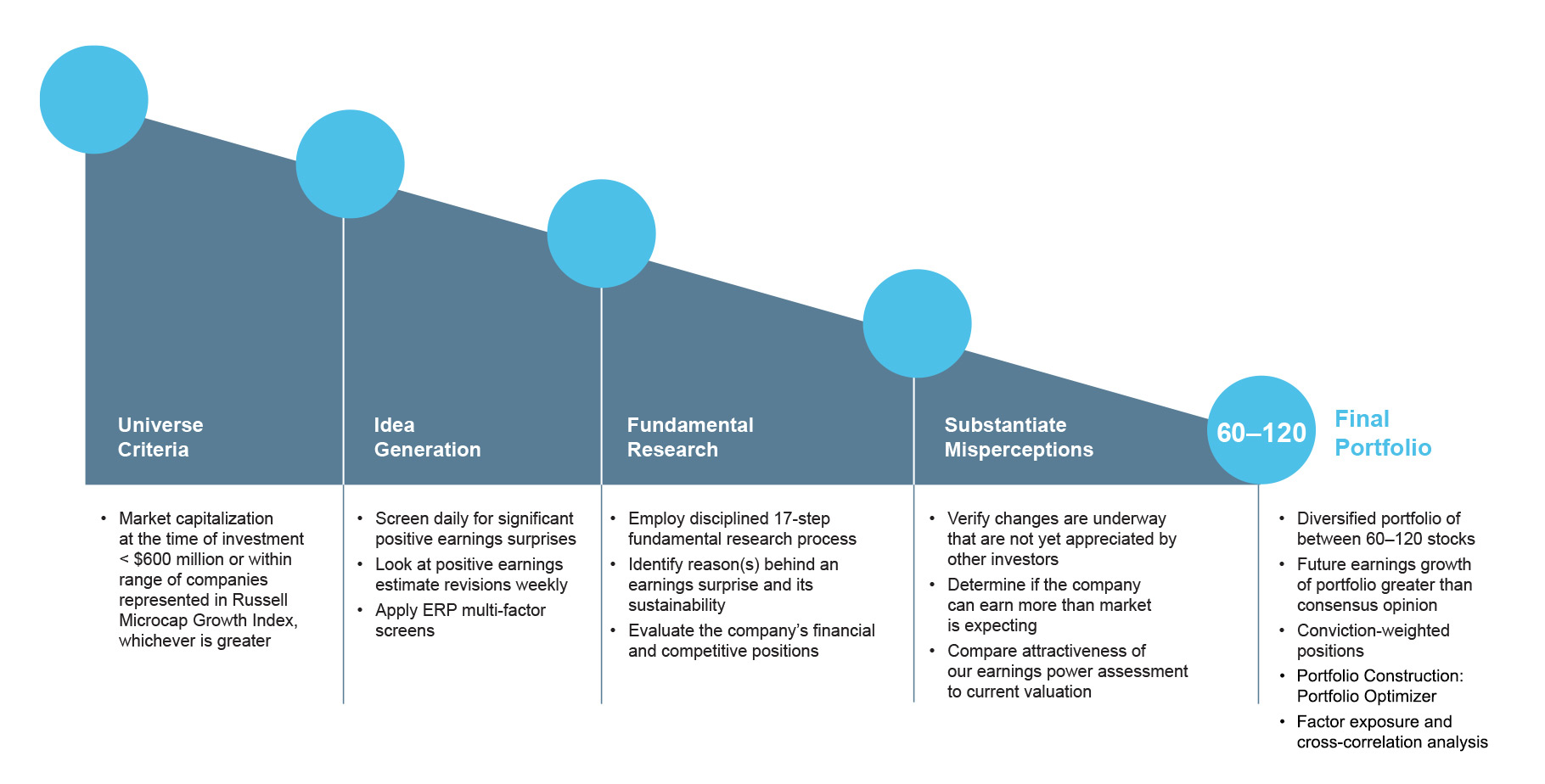

The Oberweis Micro-Cap Growth strategy seeks to capitalize on the exceptional growth potential of micro-cap companies that are often underfollowed or misunderstood by traditional Wall Street research analysts. The strategy invests in very small companies that, at the time of purchase, have a market capitalization of less than $600 million or are within the range of companies represented in the Russell Microcap Growth Index, whichever is greater. These companies often boast exciting products and/or services, a strong and sustainable competitive position, and the potential for upward revisions in earnings expectations in the future. Our fundamental research process is specifically designed to uncover such opportunities.Benefits

- Access to one of the least efficient segments of the equity market

- Potential for significant alpha over a full market cycle

- Disciplined and repeatable investment process managed by a passionate and experienced investment team

- Fundamental research process specifically designed to uncover micro-cap companies that are underfollowed or misunderstood by traditional Wall Street research analysts

- Exposure to micro-cap companies offering the potential for earnings growth that differs from consensus expectations

- Diversified portfolio with a focus on risk management