Objective

Realize a total return exceeding the MSCI World ex USA Small Cap Growth Index over a full market cycle.Investment Strategy

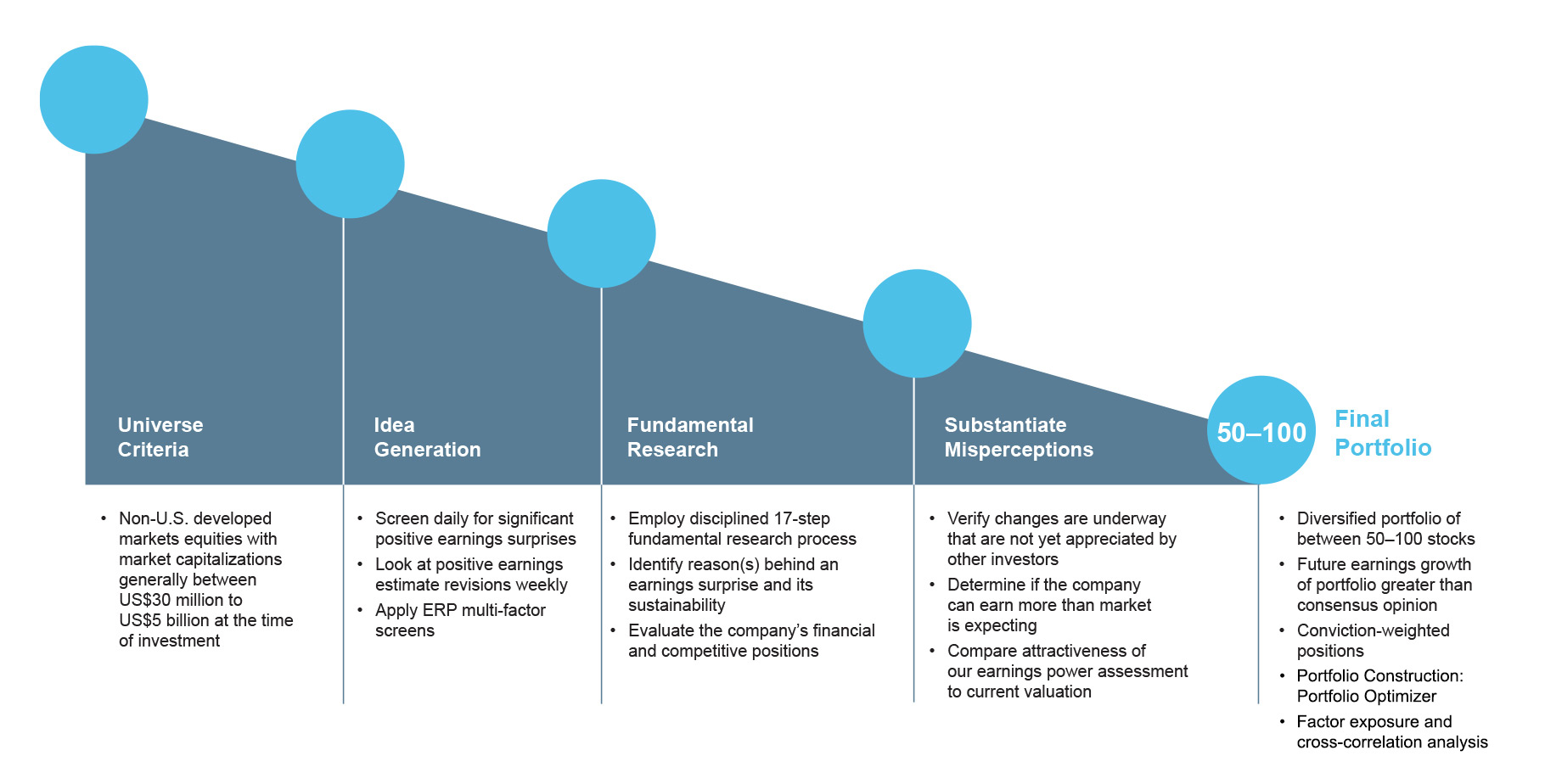

The Oberweis International Opportunities strategy seeks to identify and capitalize on the investment opportunities offered by smaller companies in Europe, the UK, Canada, Asia, Japan, and Latin America. The strategy focuses on identifying less well-known small-cap companies which traditionally receive less coverage than larger companies, consequently providing unique opportunities to unearth hidden values.Benefits

- Diversified portfolio of smaller, non-U.S. companies with higher than expected earnings potential

- Combines empirically-documented Behavioral Finance principles with the very best of fundamental bottom-up research

- Access to attractive but lesser-known foreign companies that do not receive significant institutional coverage, but possess higher than expected growth potential

- Achieve a more effective asset allocation, and greater long-term diversification of their portfolios, through investments in non-U.S. equities

- Invest primarily in developed markets with some exposure to emerging markets

- Potential for significant alpha over a full market cycle