Objective

Realize a total return exceeding the Russell 2000 Growth Index over a full market cycle.Investment Strategy

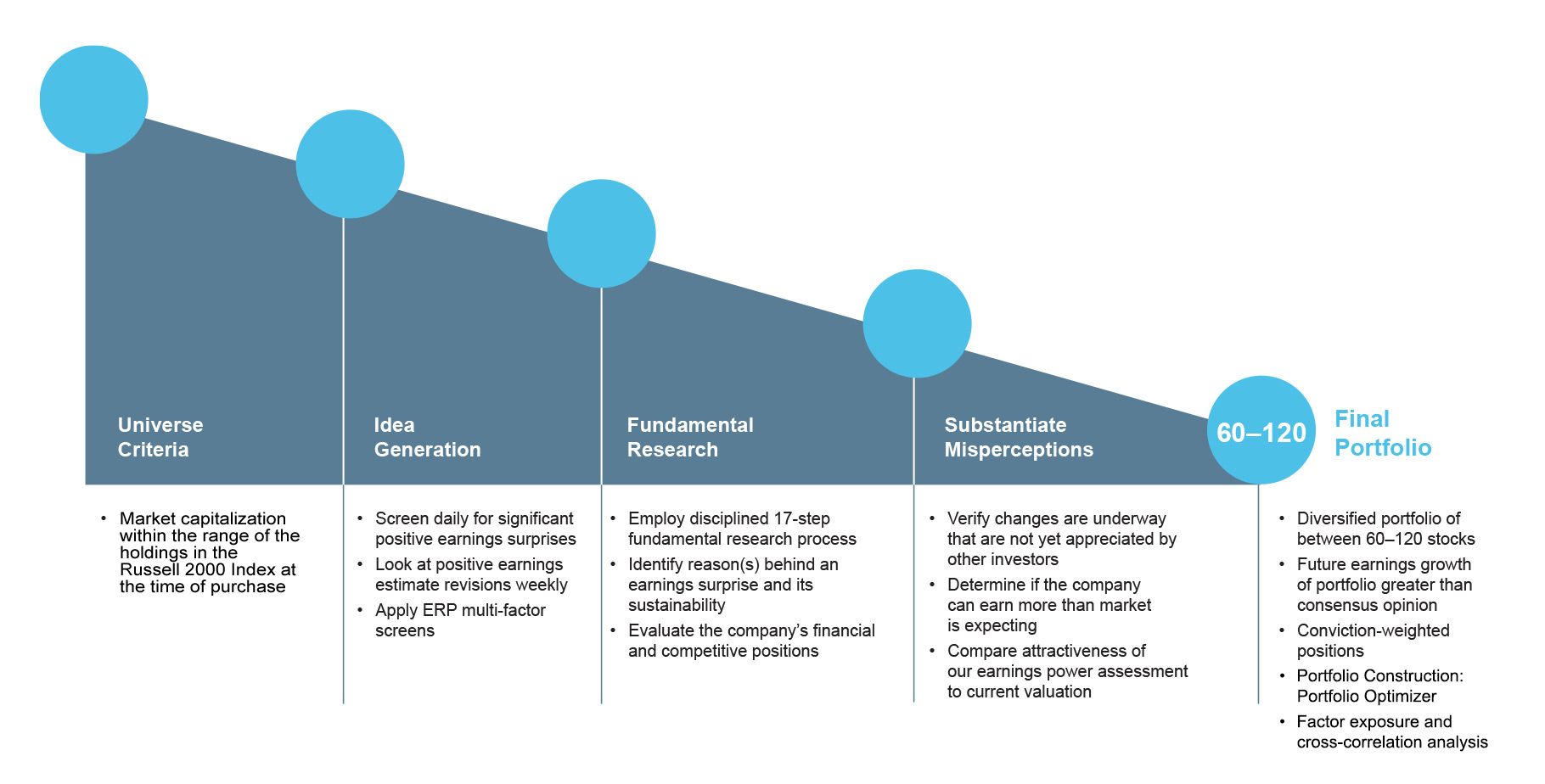

The Oberweis Small-Cap Opportunities strategy seeks to capitalize on the exceptional growth potential of smaller companies that are often misunderstood by traditional Wall Street research analysts. The Oberweis Small-Cap Opportunities strategy generally invests in companies (with market capitalizations within the range of the holdings in the Russell 2000 Index at the time of purchase) where our expectations for earnings growth differ from consensus expectations. These companies often boast exciting products and/or services, a strong and sustainable competitive position, and the potential for upward revisions in earnings expectations in the future. Our fundamental research process is specifically designed to efficiently identify such opportunities.Benefits

- Potential for significant alpha over a full market cycle

- Disciplined and repeatable investment process managed by a passionate and experienced investment team

- Fundamental research process specifically designed to efficiently discover smaller cap companies that are misunderstood by traditional Wall Street research analysts

- Exposure to smaller cap companies offering the potential for earnings growth that differs from consensus expectations

- Diversified portfolio with a focus on risk management