Objective

Realize a total return exceeding the MSCI China Index over a full market cycle.Investment Strategy

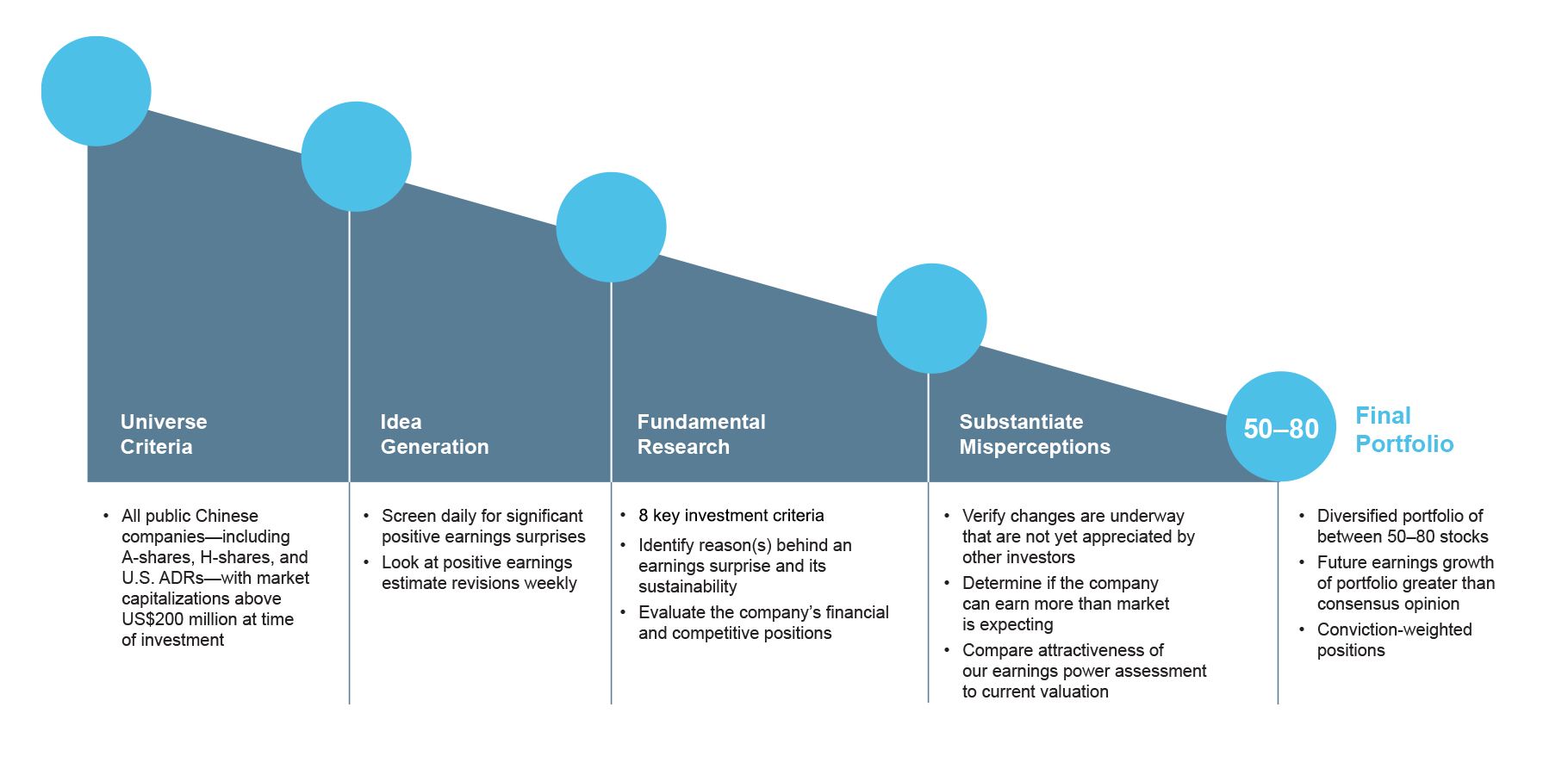

The Oberweis China Opportunities (All-Cap) strategy seeks to identify and capitalize on investment opportunities across the market capitalization spectrum, with the flexibility to invest in China A-shares, H-shares and ADRs. The strategy seeks to identify companies undergoing significant positive and transformational change likely to improve future fundamentals, earnings power and cash flow generation, particularly when the change remains misunderstood by the market. We believe our process repeatably and successfully capitalizes on these situations. Our approach to investing is differentiated and combines empirically-documented sources of alpha (backed by empirical evidence from research in behavioral finance) with rigorous fundamental bottom-up research.Benefits

- Participation in China’s economic transformation from a focus on investment and exports to a focus on consumption and technological innovation, leading to a more resilient and sustainable economic growth model

- Given the magnitude of China’s economy and its velocity of change, opportunities for large-scale secular growth stories are more tangible than in most other markets

- Relatively less efficient market with many companies under-researched, resulting in significant alpha opportunities

- Disciplined and repeatable investment process that combines empirically-documented behavioral finance principles with high quality fundamental bottom-up research

- Globally-experienced and educated investment team based in China and Hong Kong with local cultural and language understanding

- All-Cap focus allows our team to take advantage of misunderstood Chinese companies throughout the capitalization spectrum

- Flexibility to invest and take advantage of valuation disparities in China A-shares, H-shares and, to a lesser extent, ADRs

- Team operates in a non-bureaucratic culture and can act nimbly and quickly on important investment decisions

- We are a high active share manager